Research Insights, December 05, 2024

A Look in the Rearview: How Our 2024 Outlook Has Stacked Up

In 2024, inflation began to level off, the labor market showed signs of cooling, and the Fed lowered interest rates after a record hike cycle. As we move toward finalizing our outlook for 2025, we took a moment to reflect on five key predictions from our 2024 House Views that came to fruition.

---

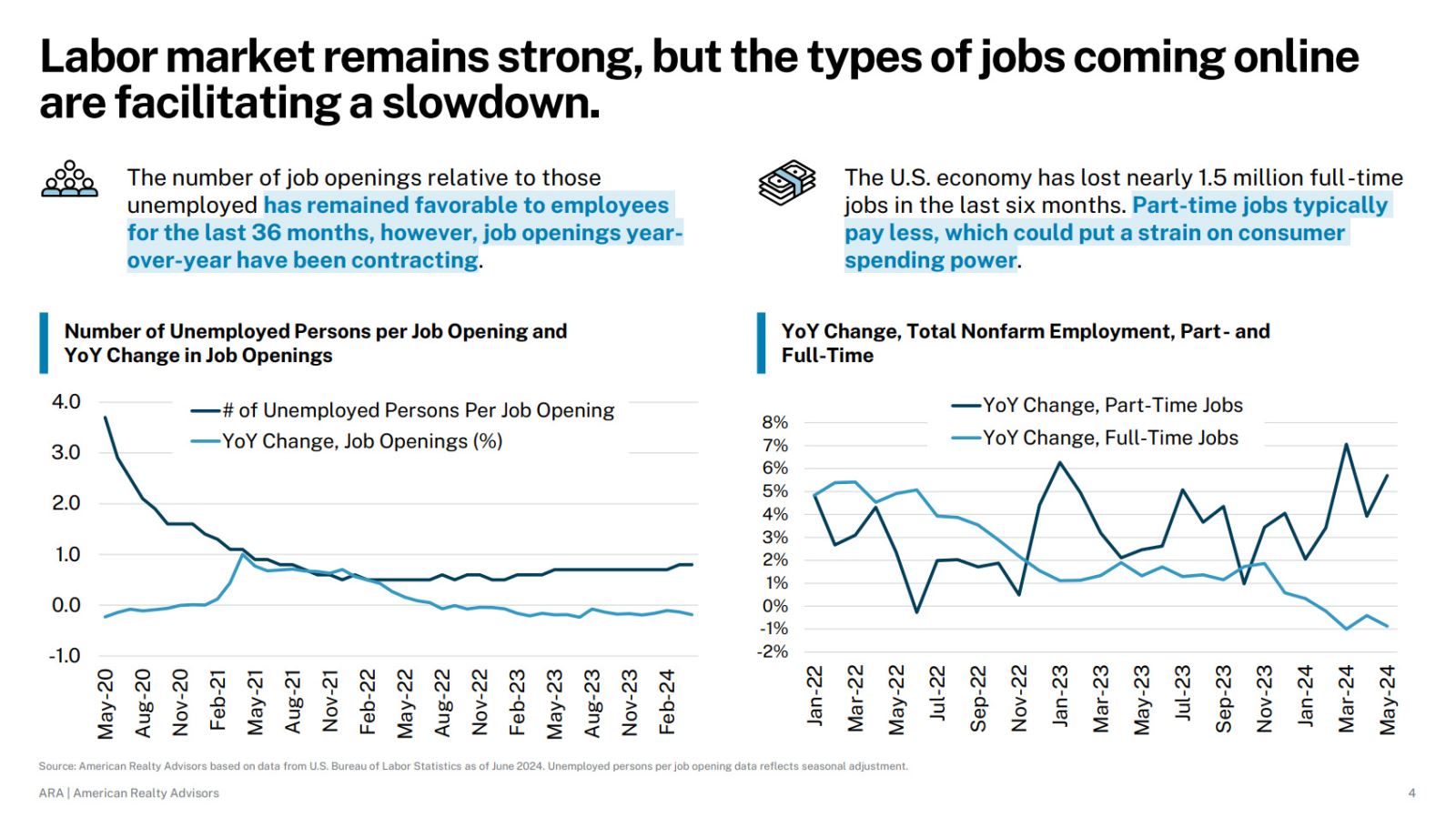

Take #1: The labor market remains healthy but is facilitating a slowdown.

Source: ARA Mid-Year 2024 Outlook

Over the summer, we thought that the labor market was showing overall signs of resiliency, but that the composition of jobs being added (more part time than full time) was indicative of ongoing moderation.

To date, that view has continued to hold. Nonfarm payrolls expanded by a modest 12,000 jobs in October, and though this was a function of one-time effects from strikes and hurricanes, downward revisions to earlier months’ gains seem to confirm that the job market has cooled.

Ongoing uncertainty surrounding how President-elect Trump’s policy agenda will materialize, particularly in light of what is viewed to be a direct impact to interest rates, could keep job growth muted until later in 2025 when the potential for corporate tax cuts may stimulate more activity.

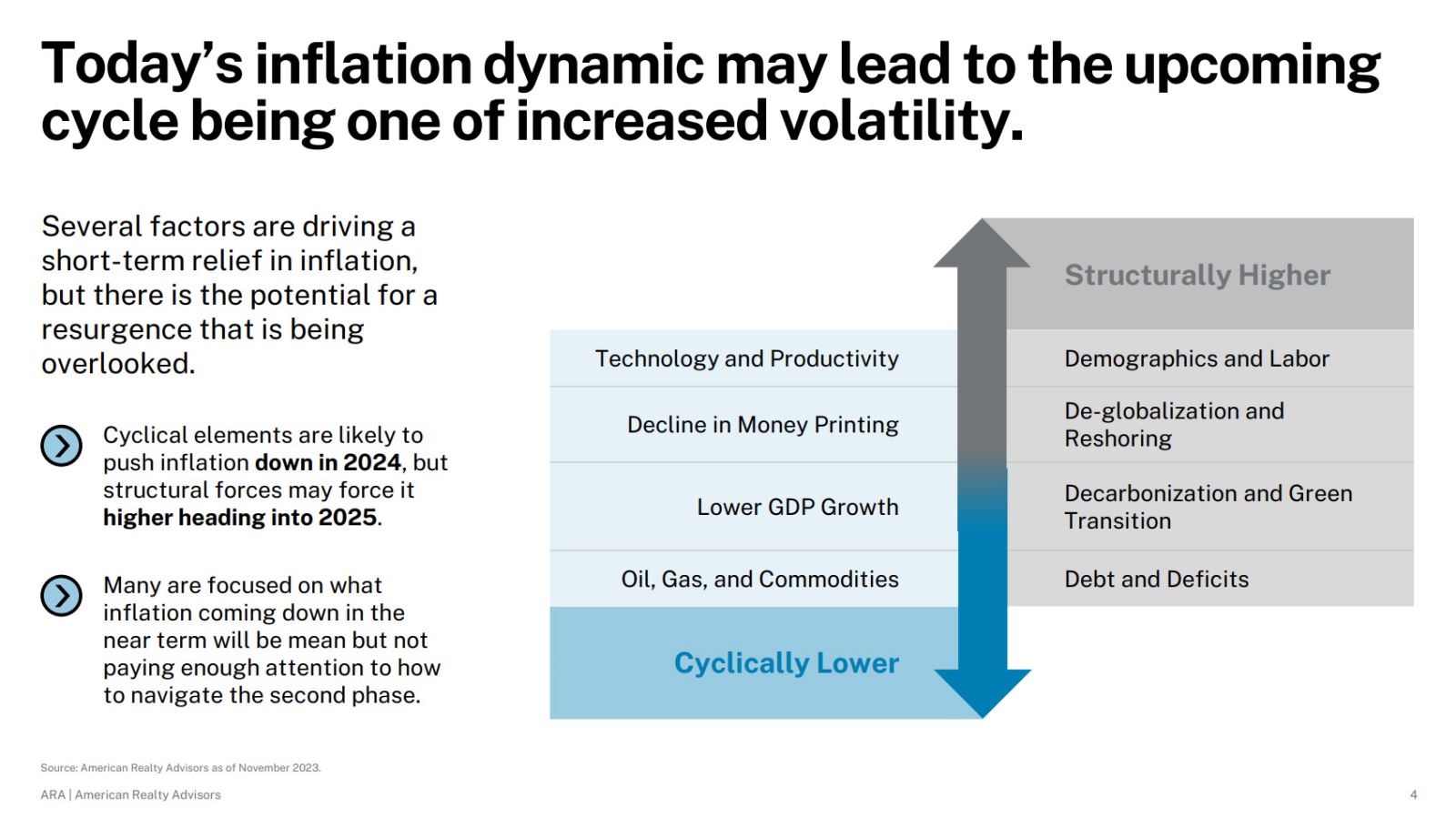

Take #2: Inflation should continue to ease in the near term, but risks remain firmly skewed to the upside.

Source: ARA H1 and Mid-Year 2024 Outlooks

Our January House View outlined an expectation that the coming cycle, as it related to inflation and policy, was going to be one of two distinct phases: the first marked by inflation trending gradually lower, allowing for central bank officials to switch to easing through the end of 2024, followed by inflation trending back up amidst more structural elements starting in 2025. The takeaway was that policy tooling, both easing and tightening, may become a more frequent element of the investment backdrop in the coming cycle than it has been for the last several.

Our January House View outlined an expectation that the coming cycle, as it related to inflation and policy, was going to be one of two distinct phases: the first marked by inflation trending gradually lower, allowing for central bank officials to switch to easing through the end of 2024, followed by inflation trending back up amidst more structural elements starting in 2025. The takeaway was that policy tooling, both easing and tightening, may become a more frequent element of the investment backdrop in the coming cycle than it has been for the last several.

This is one take where we feel we were both good and lucky. Progress on inflation has stalled a bit in recent months, but overall, the rolling six-month numbers reflect a generally welcomed downward trajectory compared to the highs from even one year ago. Fed policy easing came out of the gates with a demonstrative 50-basis point cut in September followed by another 50 in November, all of which tracks nicely with our “Phase I” take. The recent uptick in inflation has sparked a more dovish lean in Fed commentary, with the takeaway being that the Fed may not be in as much of a rush to deliver on market wishes for a more aggressive approach.

All the structural elements that we foresaw as being potential drivers of upside inflation beginning in 2025 are still at play and may get supercharged if President Trump delivers on his campaign promises specifically related to immigration/deportation and tariffs. We have been pricing in lesser rate cuts than the broader bond market throughout the year, and that strategy appears to have been prudent.

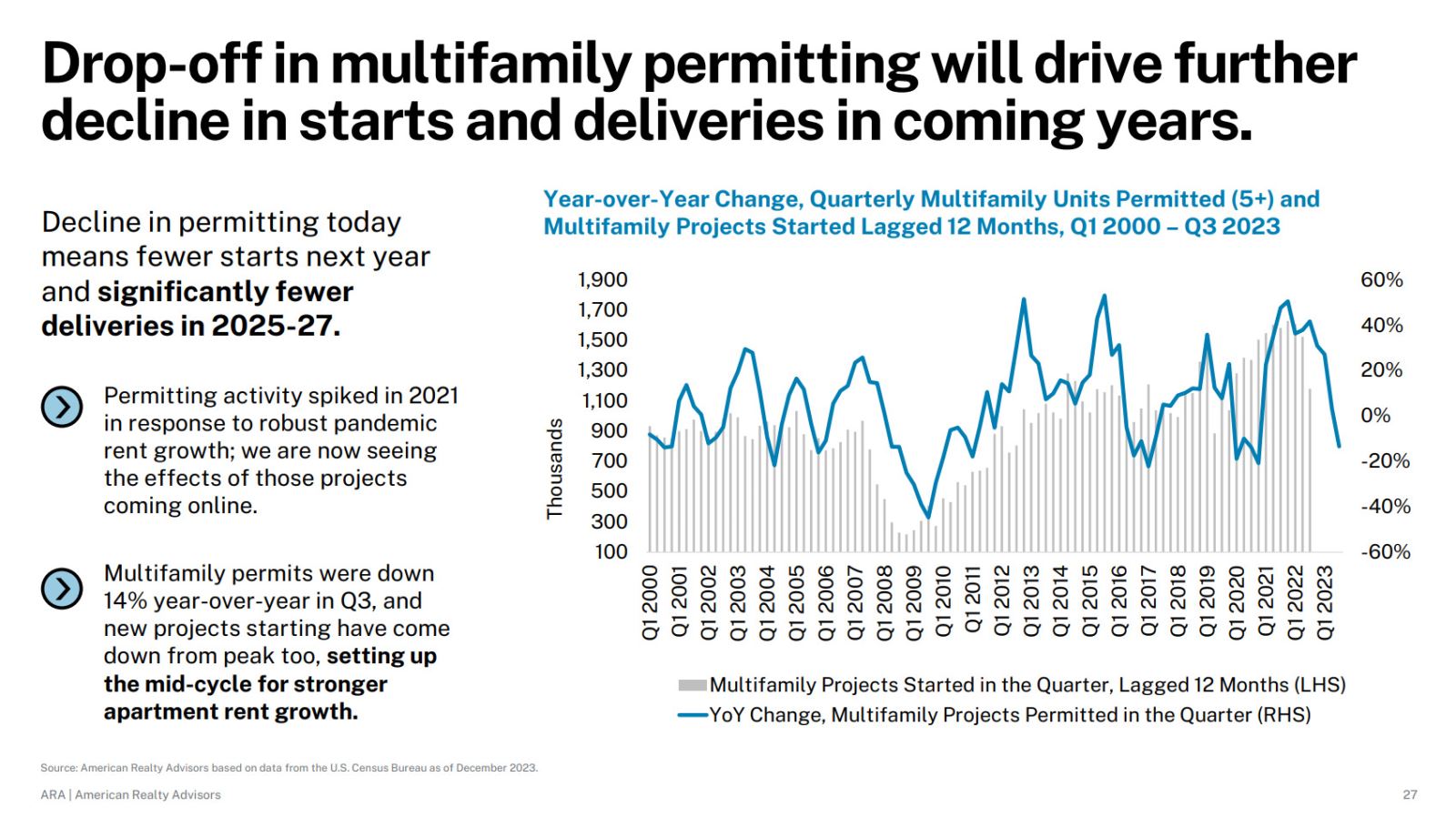

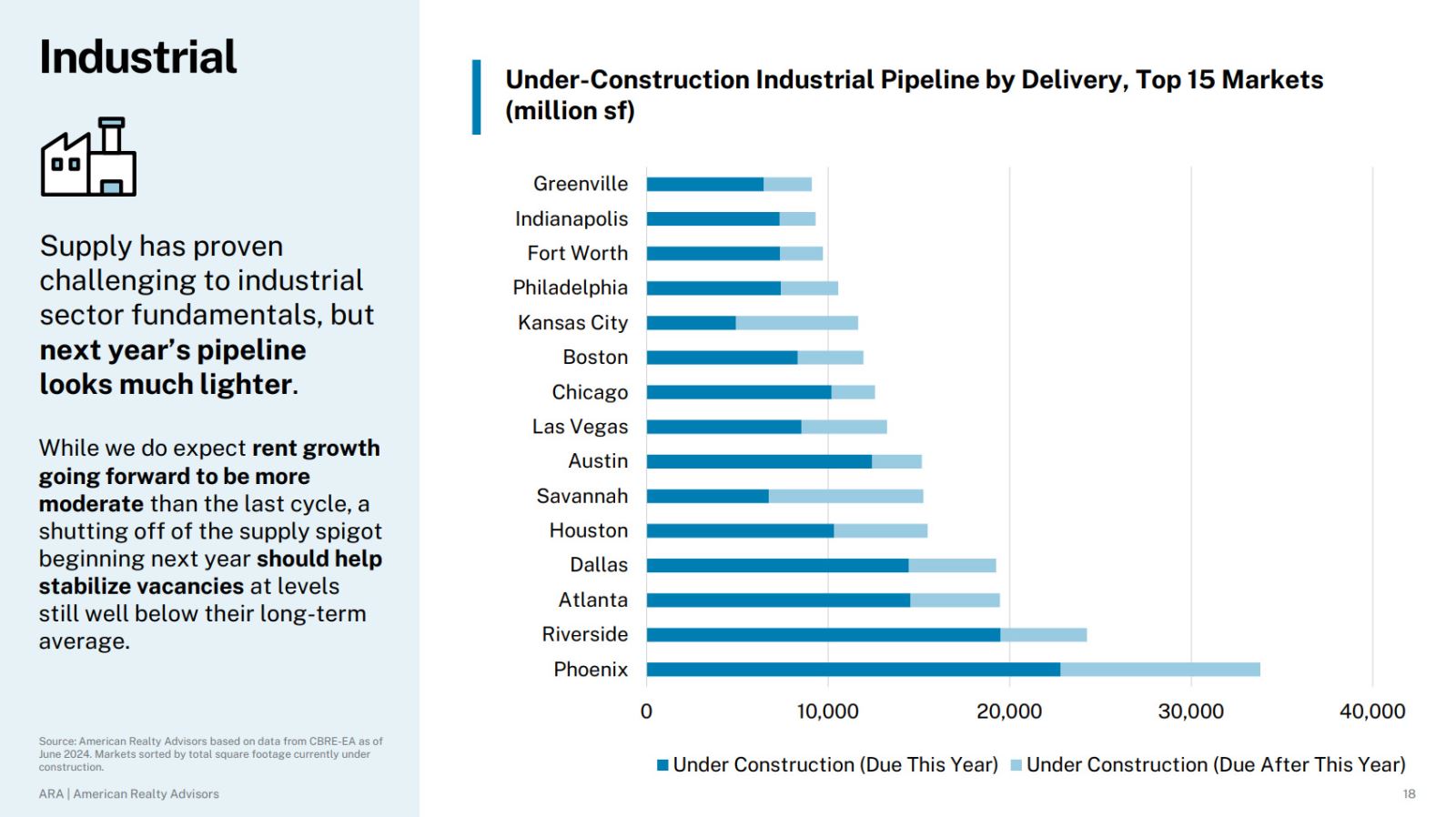

Take #3: The dramatic turn-off of the supply spigot would help support a bottoming in fundamentals.

Source: ARA H1 and Mid-Year 2024 Outlooks

The unleashing of record levels of supply in the multifamily and industrial sectors resulted in soft fundamentals across many markets entering the year. Our outlook suggested that these pressures were likely to start easing as deliveries were gradually absorbed, and that a relative dearth of new projects could create conditions more conducive to rent growth heading into 2025 and beyond.

The unleashing of record levels of supply in the multifamily and industrial sectors resulted in soft fundamentals across many markets entering the year. Our outlook suggested that these pressures were likely to start easing as deliveries were gradually absorbed, and that a relative dearth of new projects could create conditions more conducive to rent growth heading into 2025 and beyond.

So far, that appears to be playing out as expected. Multifamily permitting in the year through September was below the pre-pandemic (2015-19) annual average and down 17.4% on an annual basis. Industrial construction starts have been contracting for eight consecutive quarters. Market-wide occupancies appear to be bottoming out, and forecasts for deliveries in 2026-27 have been reduced by some data providers’ by as much as 30% compared to expectations for the same period a year ago.

This reprieve from new competition is expected to fuel the nascent recovery in occupancy and serve as a base from which owners can start to increase rents.

Take #4: Office recovery expected to be protracted despite ongoing push for return-to-office.

Source: ARA H1 and Mid-Year 2024 Outlooks

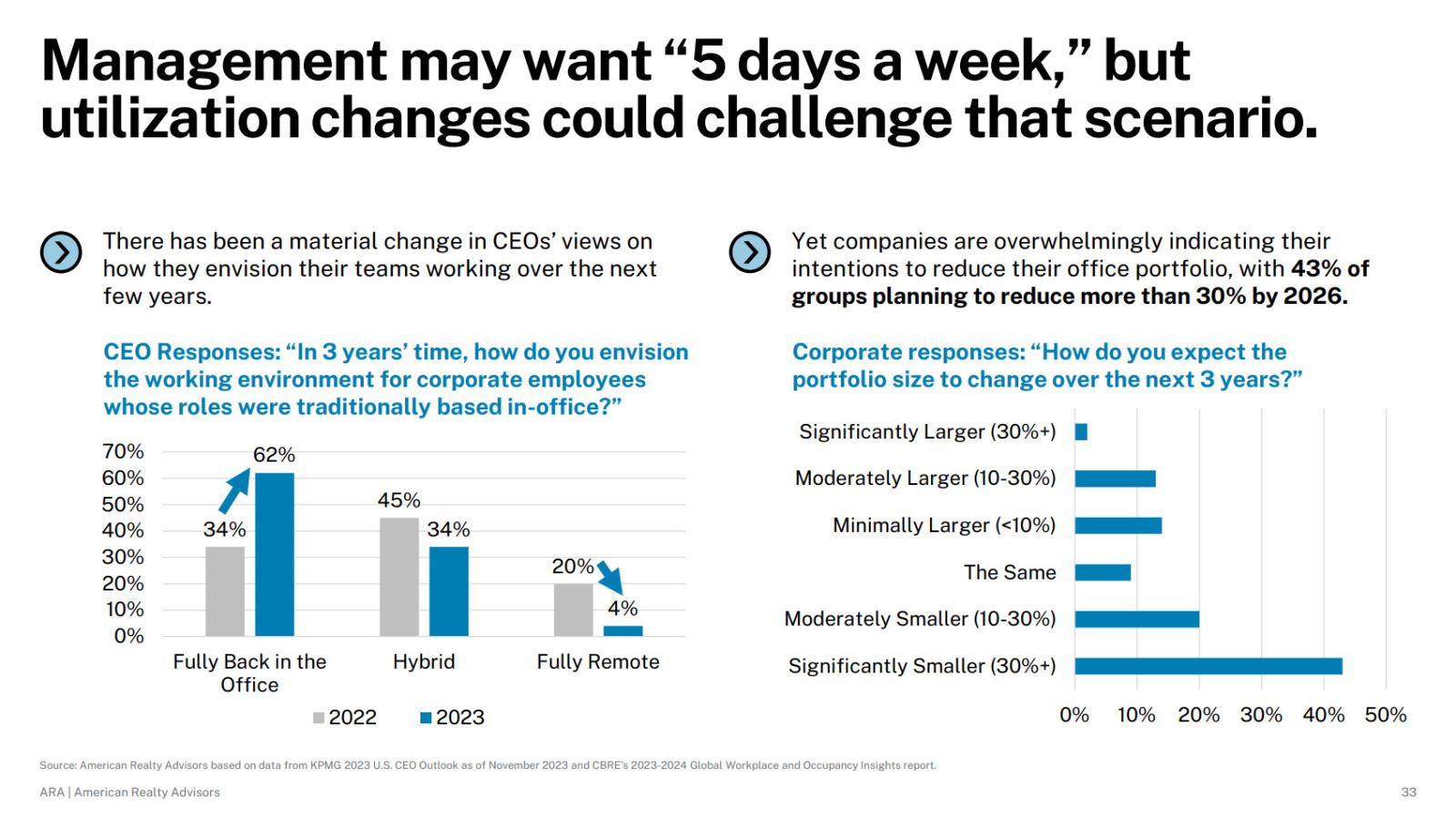

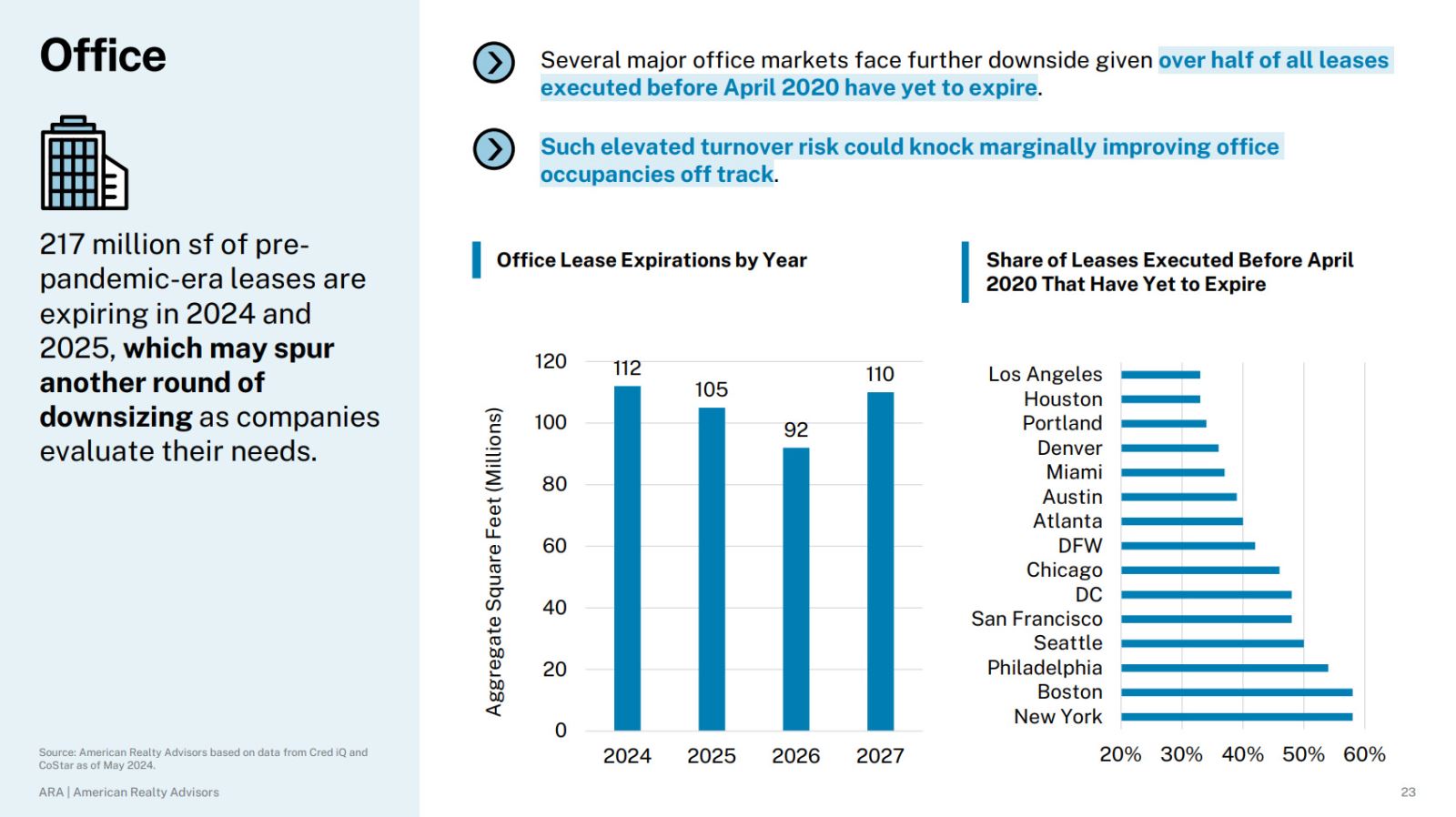

The office sector has arguably been under the greatest scrutiny in the post-pandemic period, as corporate users grapple with formalizing and enforcing their return-to-office strategies against a backdrop of structurally lower unemployment. The push-and-pull between these two forces has spurred strong opinions on what the future of office holds for investors.

The office sector has arguably been under the greatest scrutiny in the post-pandemic period, as corporate users grapple with formalizing and enforcing their return-to-office strategies against a backdrop of structurally lower unemployment. The push-and-pull between these two forces has spurred strong opinions on what the future of office holds for investors.

Our view over the last several years has been that there remained further disruption to come in the aggregate as companies considered downsizing their total footprints to accommodate the increased costs of moving into higher-quality space (the rationale being a better office should spur greater attendance, and all else being equal, a smaller but more highly occupied office at the same cost is more valuable).

The results have been mixed. According to CBRE, the number of leases signed in the first half of 2024 were up slightly from the same periods in 2018 and 2019, though they were 27% smaller on average; new leases were, on average, 32% smaller than pre-pandemic averages (vs. 21% shrinkage on renewals); however, occupiers have favored renewals in place more than relocations, with the former accounting for 42% of activity versus 31% pre-pandemic. All told, the data suggests our belief in corporations continuing to explore reducing their office square footage was correct, but the expectation that it was being done to accommodate building-to-building moves may be a bit more nuanced.

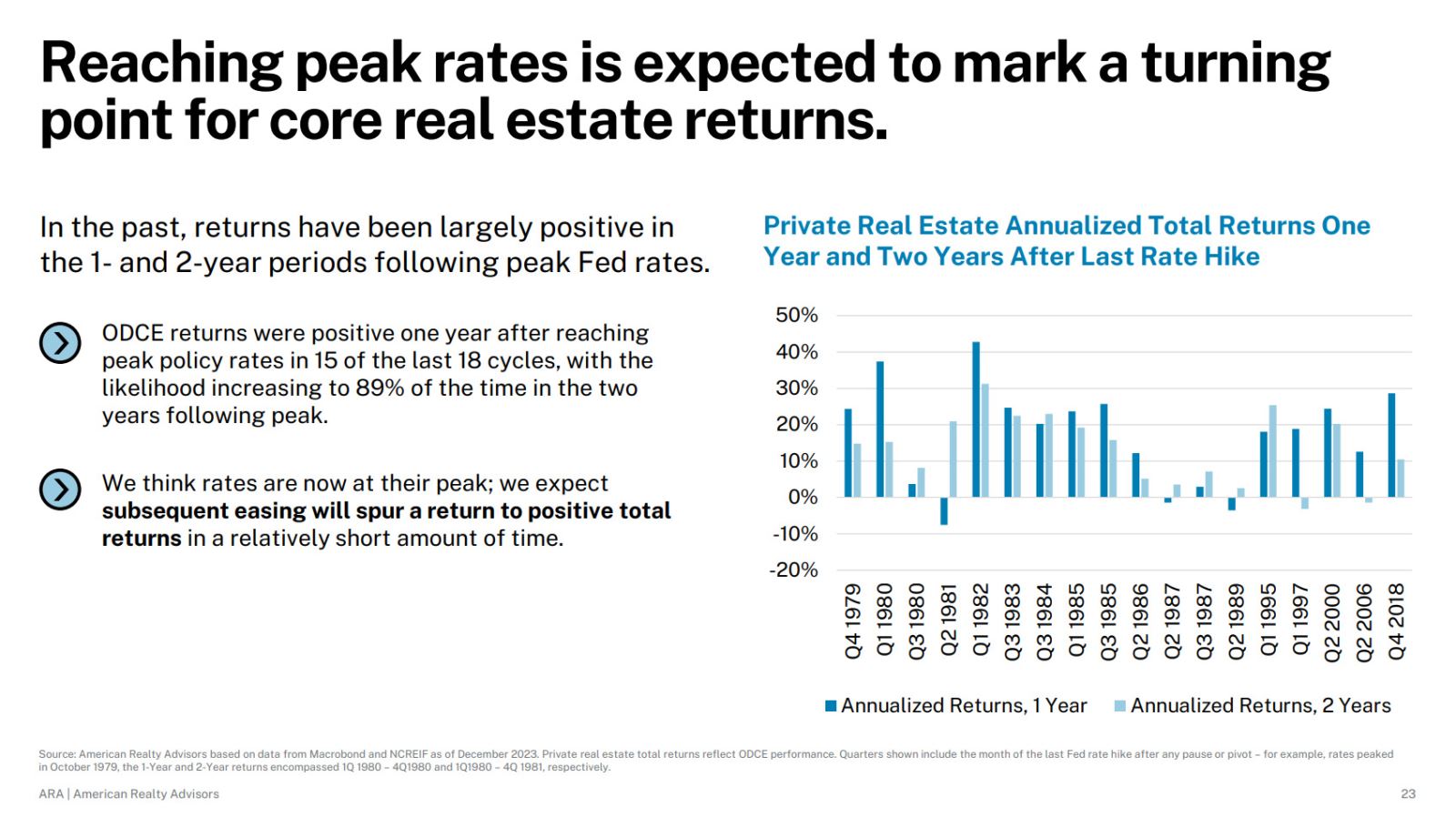

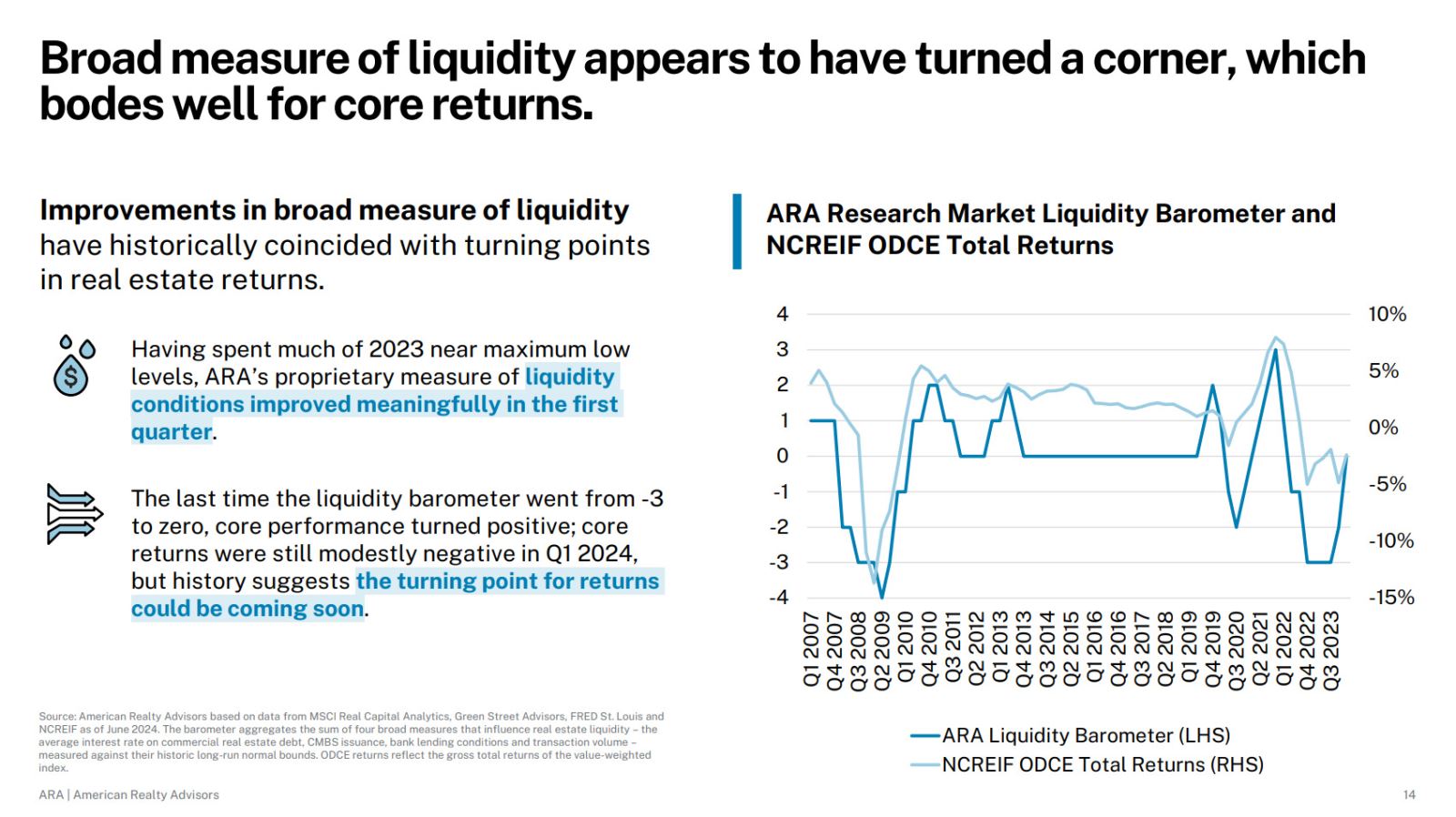

Take #5: Interest rates peaking and an improvement in liquidity should spur a return to positive returns in real estate.

Source: ARA H1 and Mid-Year 2024 Outlooks

At the beginning of the year, real estate core fund total returns had been negative for five consecutive quarters, and the key question from investors was “How much further is there to go?” Looking back, we noted that ODCE returns had tended to move back into positive territory within a year of peak rates being reached 83% of the time, and at the time we did not envision any more rate hikes. Six months forward, we considered an additional critical element to core returns, liquidity, and suggested (using our own in-house broad measure of liquidity conditions) that core returns were likely to turn positive in relatively short order.

At the beginning of the year, real estate core fund total returns had been negative for five consecutive quarters, and the key question from investors was “How much further is there to go?” Looking back, we noted that ODCE returns had tended to move back into positive territory within a year of peak rates being reached 83% of the time, and at the time we did not envision any more rate hikes. Six months forward, we considered an additional critical element to core returns, liquidity, and suggested (using our own in-house broad measure of liquidity conditions) that core returns were likely to turn positive in relatively short order.

Q3 2024 total gross returns for the NCREIF ODCE index posted a positive 0.25%, aligning with our expectation that the positive indicators we saw at the beginning of the year were indeed the green shoots of an early recovery, and marking the turning point investors had been searching for.

What might 2025 hold for commercial real estate?

We expect our 2025 Outlook, to be released in January, to reflect the potential for higher nominal GDP growth against a backdrop of higher inflation – a combination that historically has been a positive for real estate.

---

Discover More:

---

Disclaimer

The information in this newsletter is as of November 27, 2024, and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.