Research Insights, January 23, 2025

House View H1 2025

Progress toward a soft landing continued through the latter half of 2024, setting the stage for renewed optimism in 2025. Inflation has generally trended in the right direction, albeit slowly, without sparking any material weakening in the labor market; the critical consumer has remained resilient even in the face of higher costs and interest rates; and the economy has continued to expand.

---

While today’s environment is not without risk, we feel confident that the glidepath charted by the Fed back in 2020 has been largely successful, and that 2025 may welcome the beginning of a new macroeconomic and real estate cycle, marking a departure from pandemic-era inflation and policy conditions.

Macroeconomic Conditions

Consumers continue to bolster the economy through healthy spending. Retail sales in the three months leading up to December totaled a combined $1.87 trillion, an increase of nearly 3% from the same period in 2023, as a still-low unemployment rate has allowed for worker wages to outpace cost increases.

There are two dominant schools of thought when it comes to where the consumer goes from here: the first points to the rising share of household credit delinquencies in areas like credit cards and car loans as an early indicator that consumers may not be able to drive GDP growth for much longer and that the economy overall may not be as strong as the headline data would suggest. While there is merit to these arguments, these delinquencies are primarily concentrated in the bottom quartile of household incomes that are more exposed to higher prices; though it is an unfortunate reality for those lower income households, their effect when it comes to overall spending is relatively small and thus a drawback here is not likely to create a major ripple in the economy.

The second view, which aligns with our current House View base case, is that we are facing a growing structural deficit of available labor such that existing workers are going to be more highly in demand by employers, insinuating further wage growth. There are fewer new working-age domestic entrants into the labor force to offset a growing number of retirees, which is expected to keep unemployment relatively low by historic standards. This is further reinforced by the potential for less immigration under a new administration given rhetoric on the campaign trail. We believe this will mean a stronger position for the U.S. worker, though a more competitive hiring environment for companies. The potential downstream effect of this could be lower overall monthly job gains (as fewer potential workers reduces the ability for corporations to add head count) but higher wage growth.

When it comes to how this translates to policy rates, we continue to believe the baseline neutral Fed Funds rate will settle higher to account for embedded inflationary pressures. We expect a few more 25-basis point cuts in 2025, as there is little reason for the Fed to move more aggressively given how well the economy has held up to current rates so far.

Capital Markets

A clear positive for 2025 is the gradual improvement in financing conditions relative to what investors endured in late 2023 and 2024. The start of Fed easing in September has fueled a nascent recovery in the lending market, with expectations of more rate cuts expected to loosen conditions further. This should help support a gradual improvement in real estate transaction volumes and ultimately pricing, as greater access to debt usually helps facilitate sales that provide more transparency on values.

Valuations continue to be a key question for real estate investors, as few want to reenter while the proverbial knife is still falling. However, there are a few reasons we think now is a good time to reconsider investing in real estate:

- Stable prices amidst interest rate volatility suggests values broadly may have reached a trough: In the last month of 2024, sector-level prices held steady, capping a year that saw modest gains in most property types. With values still well below their 2022 peaks and prices holding steady despite recent volatility in the 10-Year Treasury, we believe widespread further write-downs are unlikely.

- Core fund net returns have turned positive: After seven consecutive quarters of negative net total returns, ODCE returns turned positive in Q3 2024. Though appreciation was still a drag at -0.80%, the pace of depreciation has been improving over the last year.

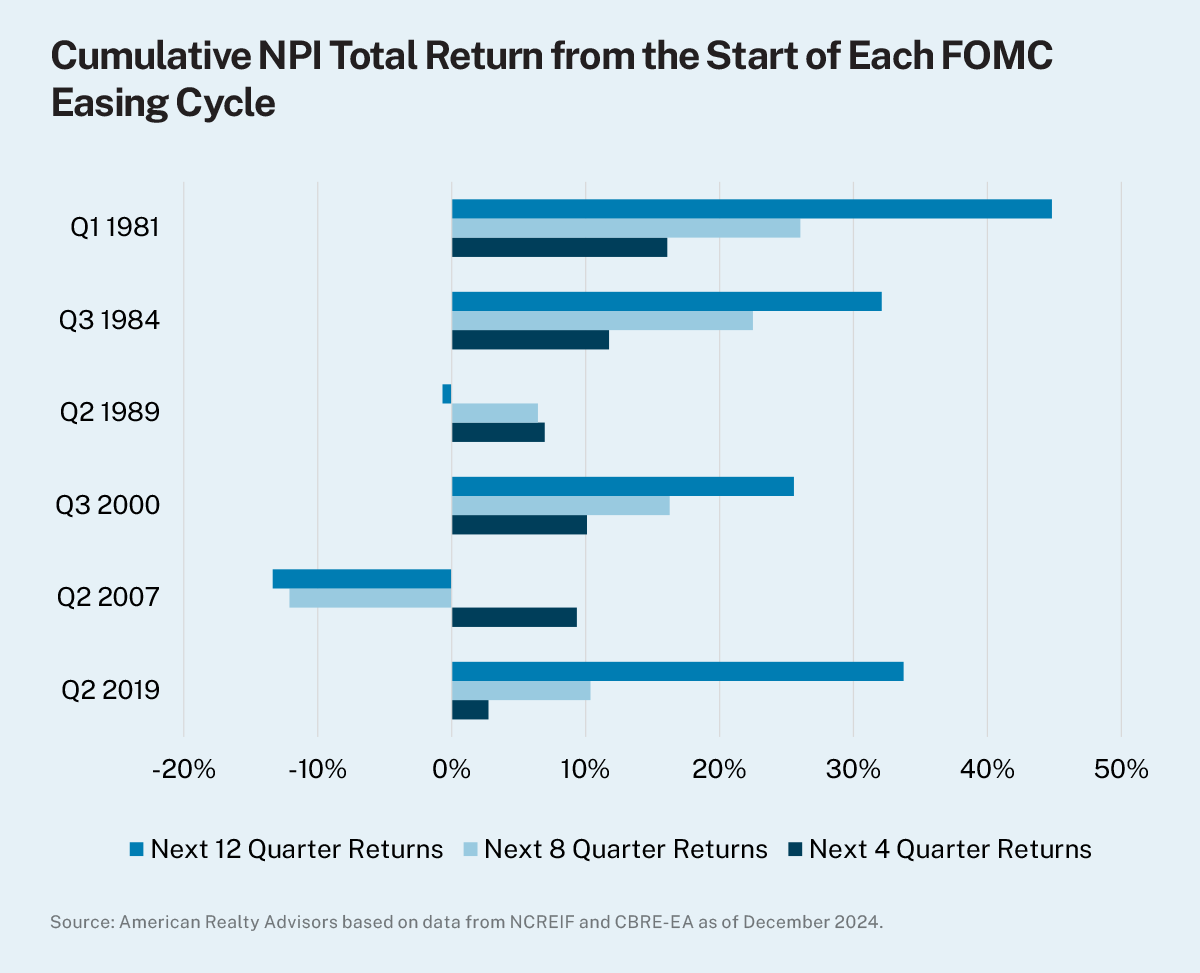

- New capital markets cycles tend to bode well for returns in subsequent years: Historically, the start of Fed rate cuts has prompted multi-year positive return runs in real estate.

Investment Implications

Property market conditions have been soft for much of the last 18 months given elevated deliveries and softening demand. Heading into 2025, the tide seems to be turning. Construction pipelines have dropped precipitously, allowing demand to start to catch up, the result of which has been a plateauing of vacancies across most markets and sectors that we believe will start to retreat as the year progresses.

Even so, we anticipate improvement from here to occur at a measured pace – though policymakers have pivoted towards easing and the uncertainty surrounding the outcome of the elections has eased, there remain unknowns that could stymie a more rapid recovery. For the office sector, it continues to be hybrid work; for industrial, the impact of potential tariffs; and for retail, high prices and a stretched middle class. Residential rentals are dealing with cyclical supply headwinds, though the structural demand case is arguably more insulated. What this translates to from an investment strategy perspective is a diligent focus on cash flow preservation in the near term and a targeted deployment strategy that prioritizes sectors, markets, and submarkets with more resilient performance profiles.

- Industrial

- Tenant demand remains strong, but leasing activity is tempered by economic and tariff uncertainty.

- A growing number of markets are seeing improved absorption levels.

- Residential

- Elevated interest rates on new mortgages are keeping homeowners in place, limiting for-sale inventory.

- 2024 demand outpaced the prior two years as an uptick in mobility has benefitted rentals.

- Office

- Decline in remote job postings is a potential positive for office occupancy rates.

- Flight to quality trends may be stronger in markets with less competition from new supply.

- Retail

- Limited construction has kept availability low, driving retailers to sign longer leases and pay higher rents for prime locations.

- Consumer preference for brick-and-mortar retail remains strong, with occupancy levels at a decades-high rate.

- Specialty Sectors

- Correlation between moving and self-storage demand suggests that markets with greater for-sale inventory offer better rent growth potential.

- Data center demand remains robust, though pushback from communities may curtail investment opportunities.

Print Charts and Figures PDF

---

More to Explore:

---

Disclaimer

The information in this newsletter is as of January 10, 2025, and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.