Research Insights, August 02, 2024

Location Matters: Multifamily Market and Submarket Selection

There are many elements that go into portfolio construction – sector selection, location selection, and asset selection. While sector selection was notable in the last cycle due to the extreme outperformance of industrial and residential properties, as we look to the next cycle, we believe a spotlight will be shined on the importance of location selection – at both a market and submarket level.

---

Does Market Selection Matter?

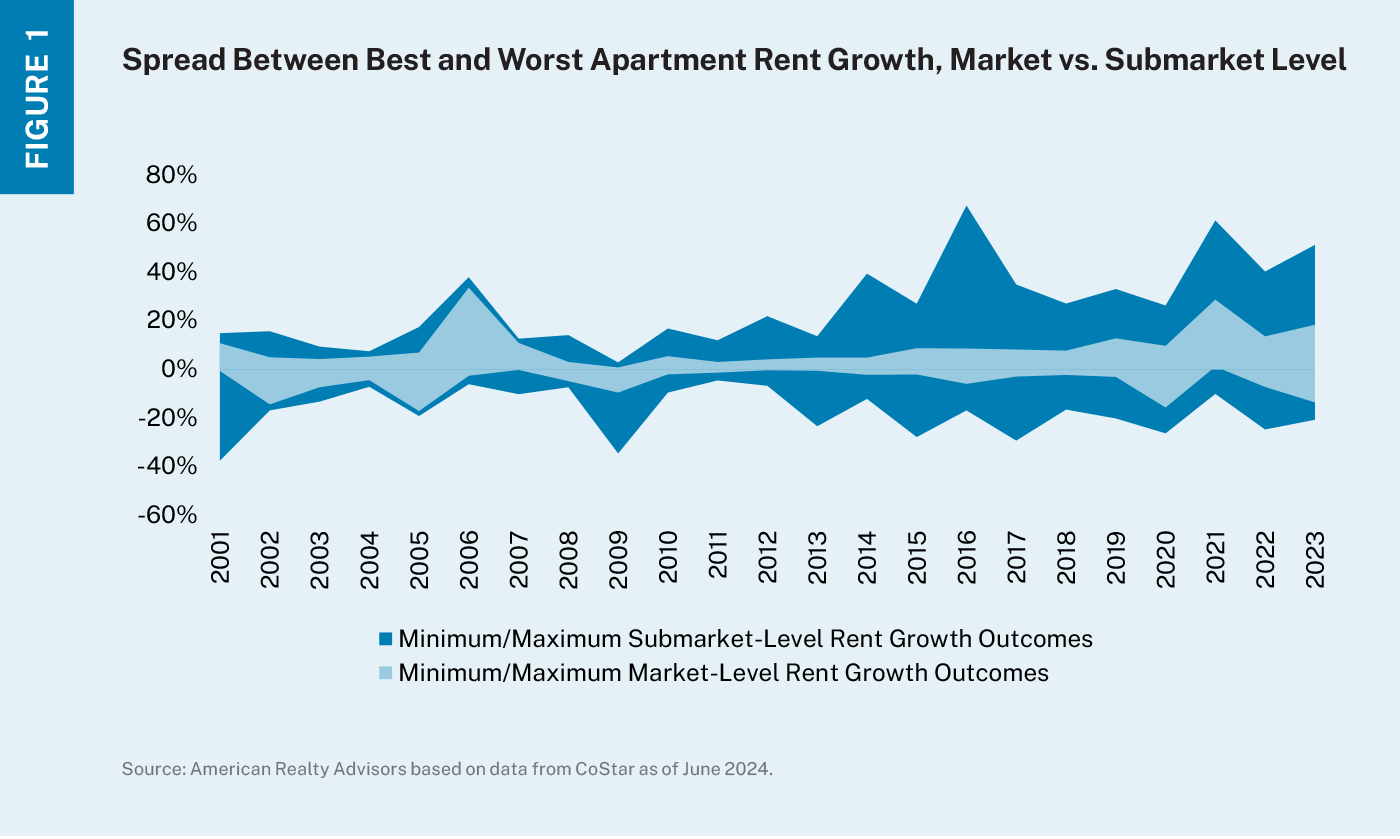

It goes without saying that some markets are winners, while others offer far less in performance when it comes to fundamental balance and rent growth. Historically, significant differences between the best- and worst-performing multifamily markets have typically occurred during periods of adjustment, such as the Global Financial Crisis, the supply surge in 2016, and the pandemic. During these times, the delta between the best- and worst- performing markets is more pronounced. Outside of these adjustment periods, rent growth in most markets tends to cluster more closely together (Figure 1), a tendency reflected in third-party forecasts for the next two years suggesting a more modest, but still meaningful, 270-basis point delta from the top to the bottom-performing markets. Though market selection still remains a key lever, as it can add a meaningful difference in outperformance, the sweet spot becomes even more pronounced when compounded with a more granular strategy, amplifying potential returns and providing a strategic edge.

Digging Deeper: Submarket Selection

While market selection can lead to outperformance, we have found that digging deeper may offer investors even more benefits. Where markets trend closely, submarkets offer more variability and higher potential rent growth relative to their broader markets, as seen in the darker band in Figure 1. On average, there’s an 870-basis point spread between the best and worst performing multifamily submarkets. This higher reward potential underscores the importance of selecting the right submarket within a broader market, as it can significantly move the needle on overall performance.

For instance, in 2016, the best-performing submarket achieved ~60% more rent growth than the best performing market did. Investors who mindfully select consistently outperforming submarkets can tap into these greater opportunities for rent growth and returns.

How Can We Predict Submarkets Primed to Outperform?

While historical performance isn’t a crystal ball, it does give us a good sense of the natural patterns within a submarket, which usually persist unless significantly disrupted by an external force. A recent case study by CBRE has highlighted the effectiveness of considering historical performance as an indicator of future performance. Using the Seattle market as a proxy, CBRE found that those submarkets that performed well in the 2010s continued performing strongly, even despite disruptions from the pandemic. This consistency shows that past performance can indeed be a useful guide for targeted selection.

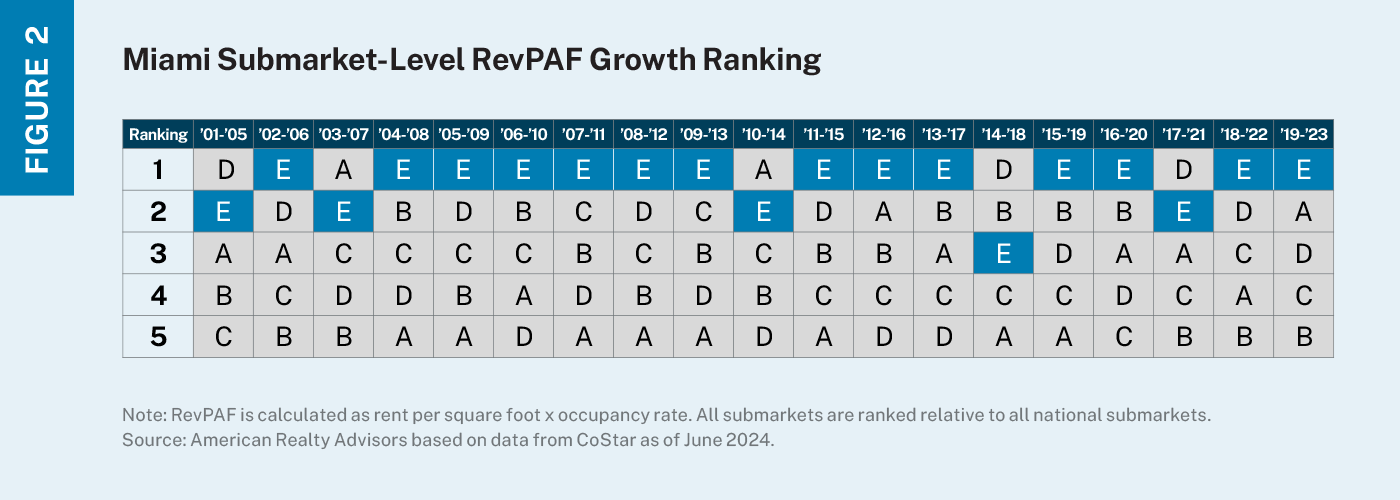

With that in mind, to get the best view of historical performance from both a supply and demand perspective, we use revenue per available foot (RevPAF), which takes rent levels and supply into account. This dual perspective helps us identify not just which submarkets have high face rent growth (perhaps by virtue of new supply delivering at considerably higher price points to the existing buildings surrounding them), but also which ones maintain occupancy and attract consistent demand. We then look at that historical performance and rank it relative to its peer set to see which submarkets have consistently outperformed. For instance, Figure 2 illustrates a condensed example of this process.

Of the five Miami submarkets represented, we can see that Submarket E frequently ranks at the top, making it the strongest choice for investment:

While choosing the right sector and market is and will always be important, we believe digging deeper into submarket performance can give disciplined investors even more of an edge. By focusing on trends at the submarket level, investors can identify areas with the highest potential for growth and resilience, even in fluctuating economic conditions. This approach can help mitigate risks and maximize returns, ensuring a well-rounded and strategic investment portfolio.

---

Discover More:

---

Disclaimer

The information in this newsletter is as of July 25, 2024, and is for your informational and educational purposes only, is not intended to be relied on to make any investment decisions, and is neither an offer to sell nor a solicitation of an offer to buy any securities or financial instruments in any jurisdiction. This newsletter expresses the views of the author as of the date indicated and such views are subject to change without notice. The information in this newsletter has been obtained or derived from sources believed by ARA to be reliable but ARA does not represent that this information is accurate or complete and has not independently verified the accuracy or completeness of such information or assumptions on which such information is based. Models used in any analysis may be proprietary, making the results difficult for any third party to reproduce. Past performance of any kind referenced in the information above in connection with any particular strategy should not be taken as an indicator of future results of such strategies. It is important to understand that investments of the type referenced in the information above pose the potential for loss of capital over any time period. This newsletter is proprietary to ARA and may not be copied, reproduced, republished, or posted in whole or in part, in any form and may not be circulated or redelivered to any person without the prior written consent of ARA.

Forward-Looking Statements

This newsletter contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are statements that do not represent historical facts and are based on our beliefs, assumptions made by us, and information currently available to us. Forward-looking statements in this newsletter are based on our current expectations as of the date of this newsletter, which could change or not materialize as expected. Actual results may differ materially due to a variety of uncertainties and risk factors. Except as required by law, ARA assumes no obligation to update any such forward-looking statements.